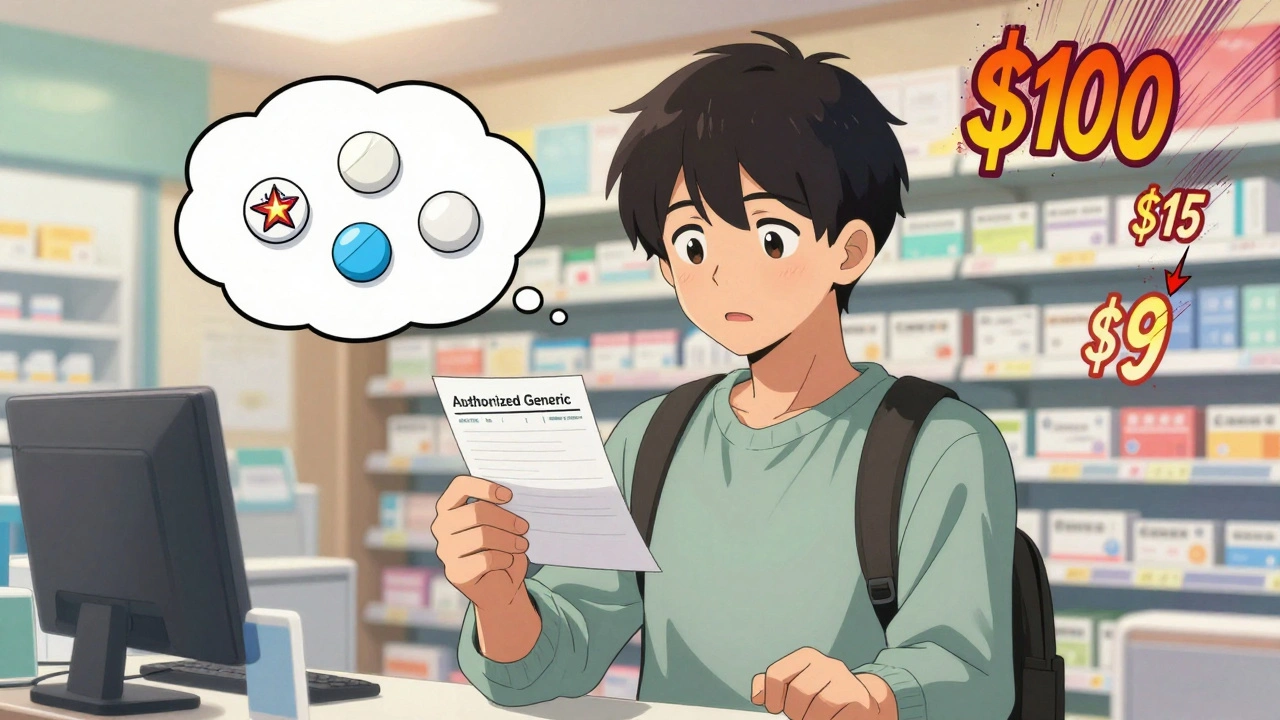

Most people don’t realize that the pill they’re paying $100 for might be identical to one that costs $5 - and it’s not magic, it’s not a scam, it’s just how the system works. If you’re spending too much on prescriptions, you’re not alone. But here’s the thing: you can cut your drug costs by up to 90% just by asking the right questions at the pharmacy.

What’s the Difference Between Generic and Authorized Generic Drugs?

Let’s start simple. A generic drug is a copy of a brand-name medication. It has the same active ingredient, same dose, same way it works in your body. The FDA requires it to be just as safe and effective. The only differences? The color, shape, or inactive ingredients - and the price. Generics usually cost 80-85% less than the brand. Now, here’s where it gets interesting: an authorized generic is actually made by the same company that makes the brand-name drug. It’s the exact same pill, same factory, same packaging - just sold under a generic label. No tricks. No cut corners. The brand company itself releases it as a generic to compete with other generics. Sometimes, they do this right after the patent expires. Other times, they wait - and that’s where things get messy.Why Authorized Generics Can Be Cheaper (Sometimes)

Authorized generics often hit the market with lower list prices than traditional generics. Why? Because the brand company doesn’t need to recoup R&D costs - they already made that money. In 2022, the FDA found that for drugs like insulin and hepatitis C treatments, authorized generics were priced 50-67% lower than the original brand. That’s huge. But here’s the catch: your copay might not reflect that. Insurance plans treat authorized generics differently than regular generics. Some put them on the same tier as brand-name drugs. Others treat them like any other generic. That means you could be paying $45 for an authorized generic insulin, even though the list price is $90 - because your plan doesn’t recognize the discount. A Reddit user from October 2023 shared: "My insulin went from $350 brand to $90 authorized generic, but my copay stayed at $45." Meanwhile, another user switched from an authorized generic to a regular generic for blood pressure and saved $20 a month - even though the pills were chemically identical.How to Ask for Savings at the Pharmacy

You don’t need to be a pharmacist to save money. You just need to ask the right questions. Here’s exactly what to say:- "Is there a generic version of this drug?" - Always start here. If the answer is no, ask why.

- "Is this an authorized generic?" - This is the question most pharmacists won’t volunteer. But if you ask, they’ll check.

- "How does my insurance treat authorized generics versus regular generics?" - This gets you into the real cost. Some plans charge more for AGs because they’re tied to the brand’s rebate structure.

- "Can I switch to a different generic version to save money?" - Sometimes, two generics for the same drug cost wildly different amounts. One might be $3, another $15. Same drug. Different manufacturer.

Why Your Copay Might Still Be High - Even With a Generic

Here’s the dirty secret: the price you see on the shelf isn’t always the price your insurance pays. PBMs (pharmacy benefit managers) negotiate rebates with drug companies. Those rebates go to the insurance company, not you. So even if the generic costs $5, your copay might still be $20 because your plan has a high deductible or tiered pricing. The FDA says 93% of generic prescriptions cost under $20. But a 2023 survey by Patients for Affordable Drugs found that 28% of people still paid over $20 for generics. Why? Because their insurance didn’t move the drug to a lower tier. Or they’re on a high-deductible plan. Or their plan treats authorized generics like brand-name drugs. Don’t assume a generic means cheap. Always check.Use Tools to Compare Prices - Cash Is King

If your insurance isn’t helping, go cash. Use apps like GoodRx or SingleCare. They show you the lowest cash price for each version of the drug - brand, generic, and authorized generic - at pharmacies near you. For example: a 30-day supply of metformin might cost $12 with insurance, $8 with GoodRx, and $4 as an authorized generic at Walmart. That’s $8 saved just by switching where you fill it. You don’t need insurance to save. You just need to know your options.

John Filby

December 3, 2025 AT 23:33